Driving Merchant Activation by Simplifying Registration & Verification in QIP Payment

Industry

Finance

Client

Telkom Indonesia

Platform

Web

Overview

QIP Payment Ecosystem, previously known as MPS, is a core payment gateway and fintech infrastructure platform under the Directorate of Digital Business at Telkom Indonesia. It was designed to unify multiple financial services—such as payment processing, disbursement, and merchant platforms—into a single, scalable ecosystem supporting Telkom’s internal digital products. In practice, QIP faced a key challenge in early-stage merchant activation. Many merchants dropped off during registration and verification due to complex flows, reliance on legacy systems, manual processes, and limited visibility into verification progress. This UX-led initiative focused on simplifying registration and verification, reducing onboarding friction, and aligning cross-functional stakeholders around activation and time-to-first-transaction as primary success metrics.

My Role

UI Designer – Enterprise Platform

I was responsible for:

Designing and aligning core UI flows (onboarding, dashboard, monitoring, and support)

Defining layout structure, visual hierarchy, and interaction patterns

Collaborating closely with UX, Product, and Engineering teams to ensure feasibility and consistency

Creating reusable UI components as a foundation for the QIP design system

Delivering high-fidelity, developer-ready designs for implementation

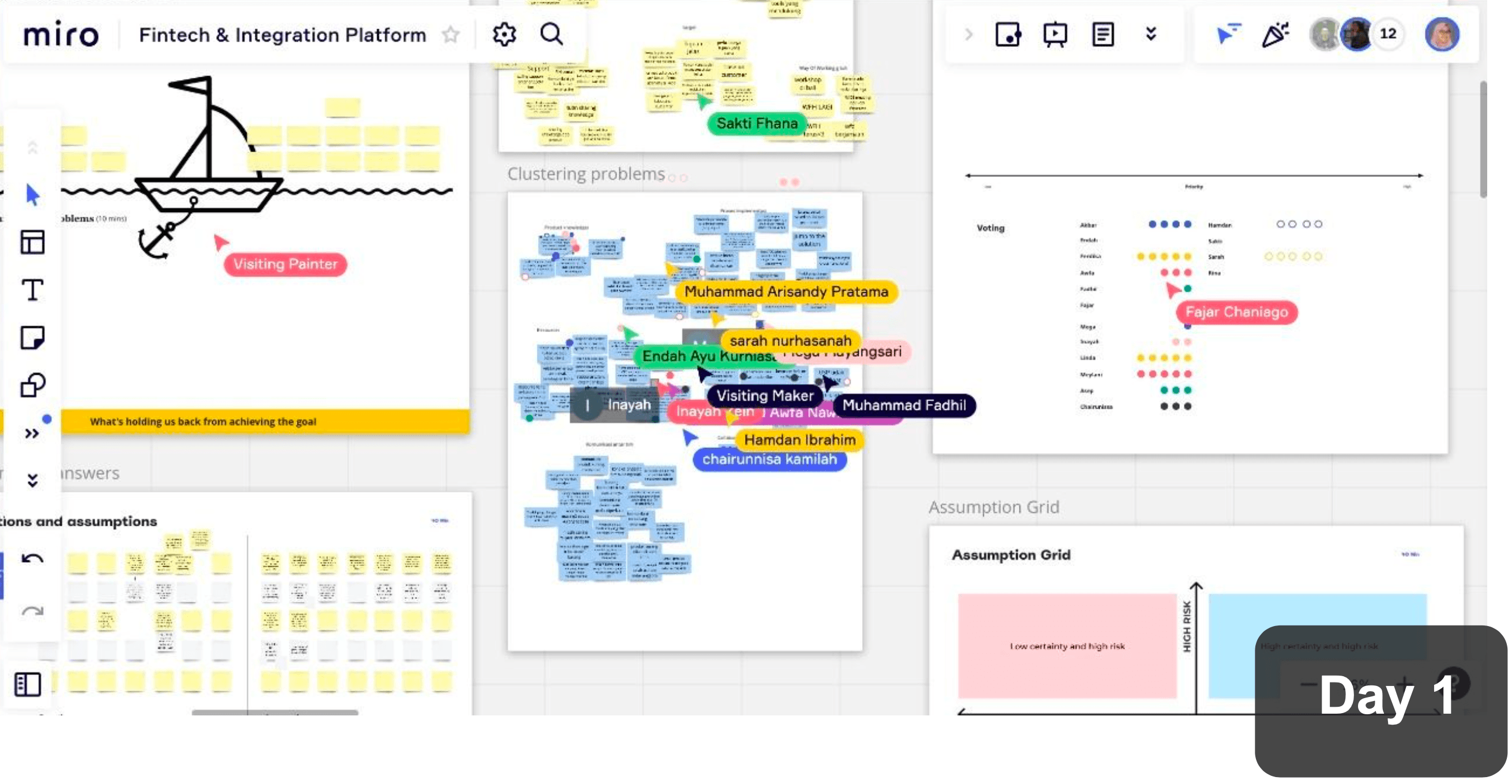

Workshop & Service Design

I participated in a series of service design–driven workshops that applied enterprise UX principles and digital strategy facilitation within Telkom’s B2B fintech context.

Days 1–2: Discovery & Alignment

Contributed to mapping key challenges and opportunities across cross-functional squads

Took part in identifying high-priority friction points, including limited technical support, unclear SOPs, fragmented onboarding processes, and disconnected end-to-end merchant journeys

Supported the synthesis of issues into cross-functional themes and helped articulate the underlying root causes

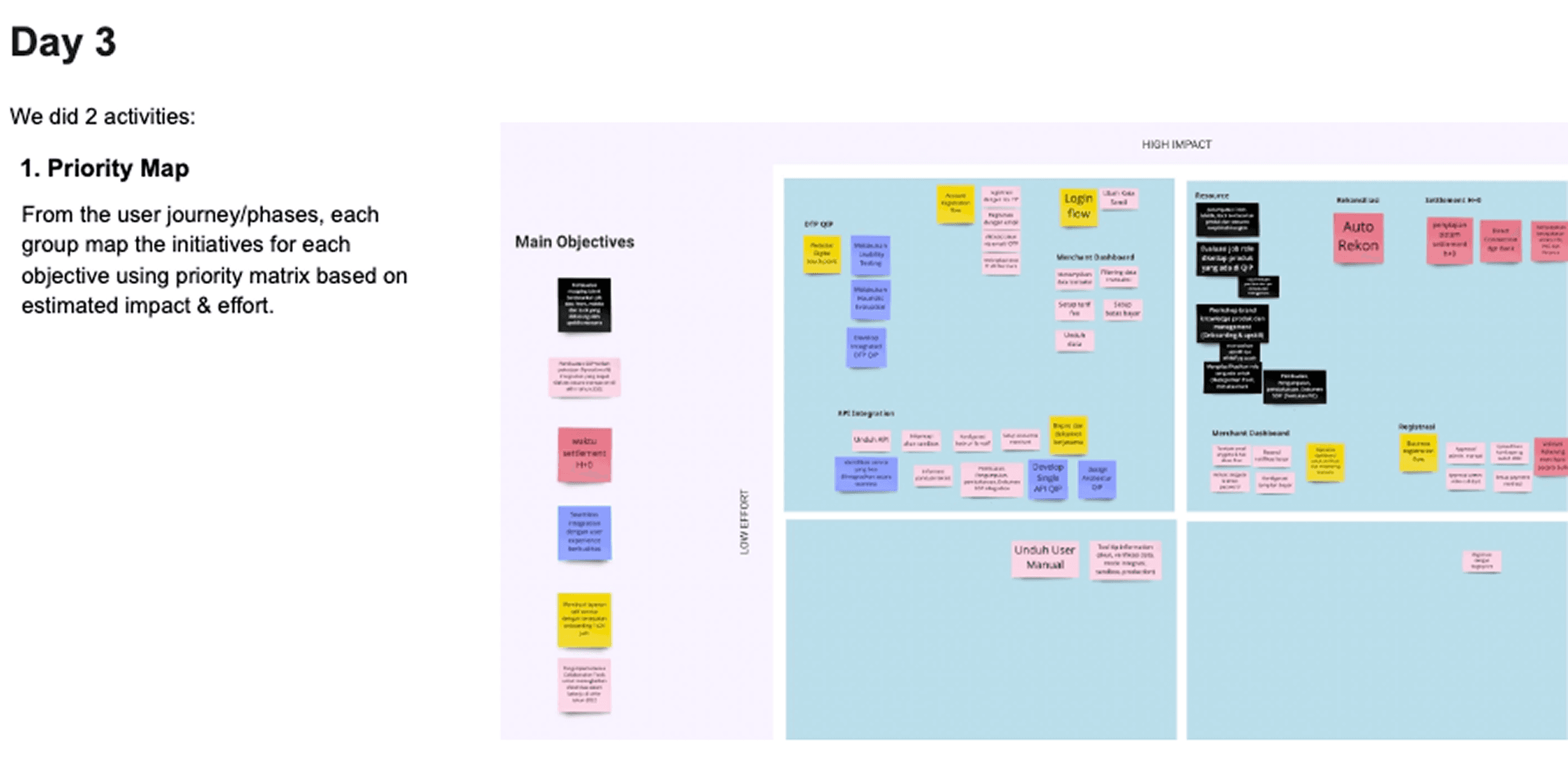

Day 3: Prioritization & Roadmap Definition

Insights from the discovery phase were translated into strategic initiatives through prioritization sessions using an impact vs. effort matrix. This helped build cross-squad consensus on development focus areas, map initiatives into a quarterly roadmap, and align features and backlogs with service-level objectives and each squad’s OKRs.

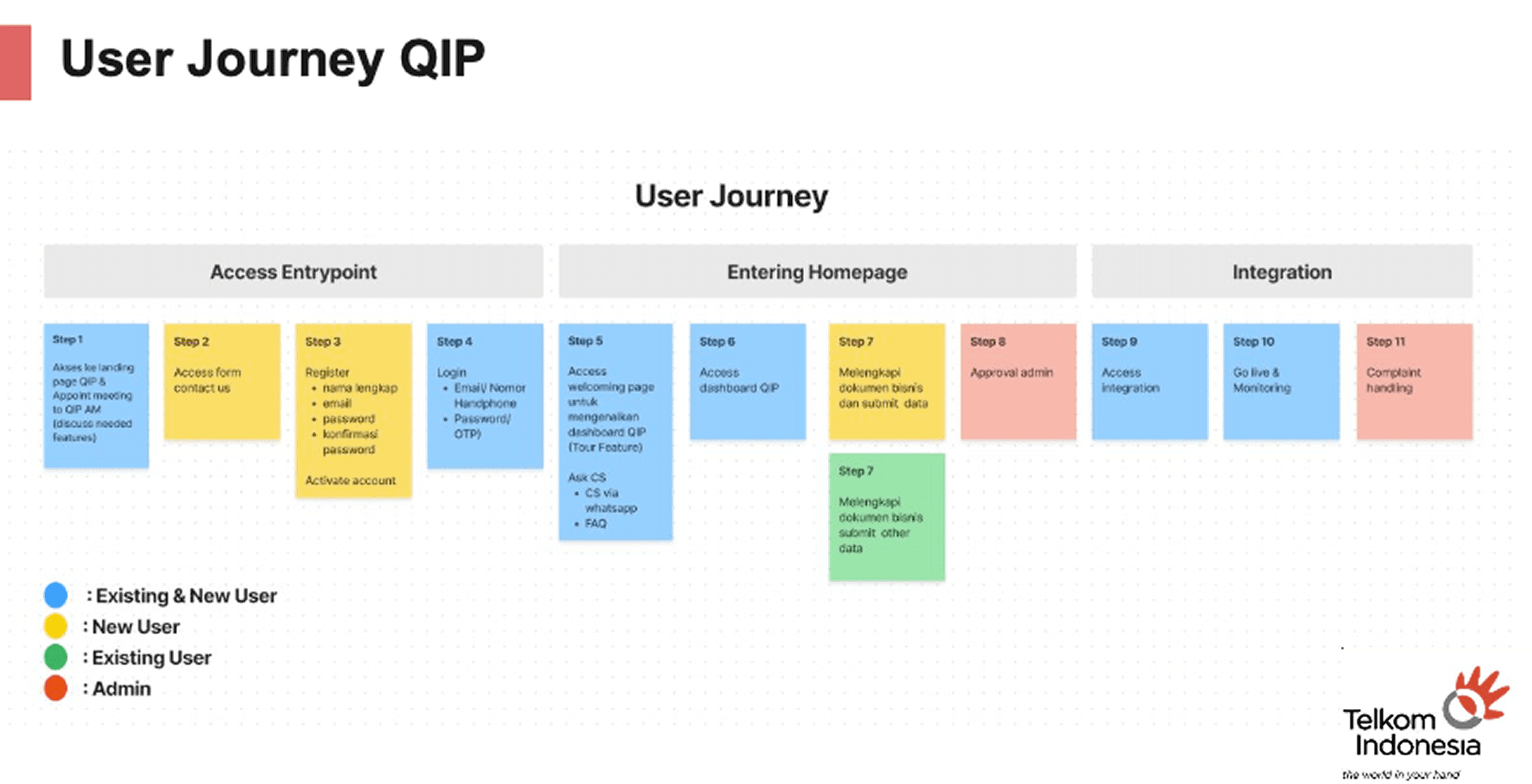

Day 4: Initiate Rebranding QIP Ecosystem & Acquisition Strategy

The workshop concluded with the initiation of the QIP ecosystem rebranding and the formulation of a digital acquisition strategy. The focus was on designing acquisition programs using a UX funnel approach and defining a clear user journey from awareness through conversion.

Objectives

Grounded in the insights and strategic direction established during the workshop, my role as a UI Designer focused on translating business and UX strategy into scalable, high quality visual solutions with the following objectives:

Establish a consistent, enterprise ready visual UI language across the QIP ecosystem

Simplify merchant onboarding and registration flows to reduce early stage friction and improve activation

Improve information hierarchy within financial and operational dashboards for better clarity and usability

Deliver reusable and well documented UI components to support long-term product scalability and consistency

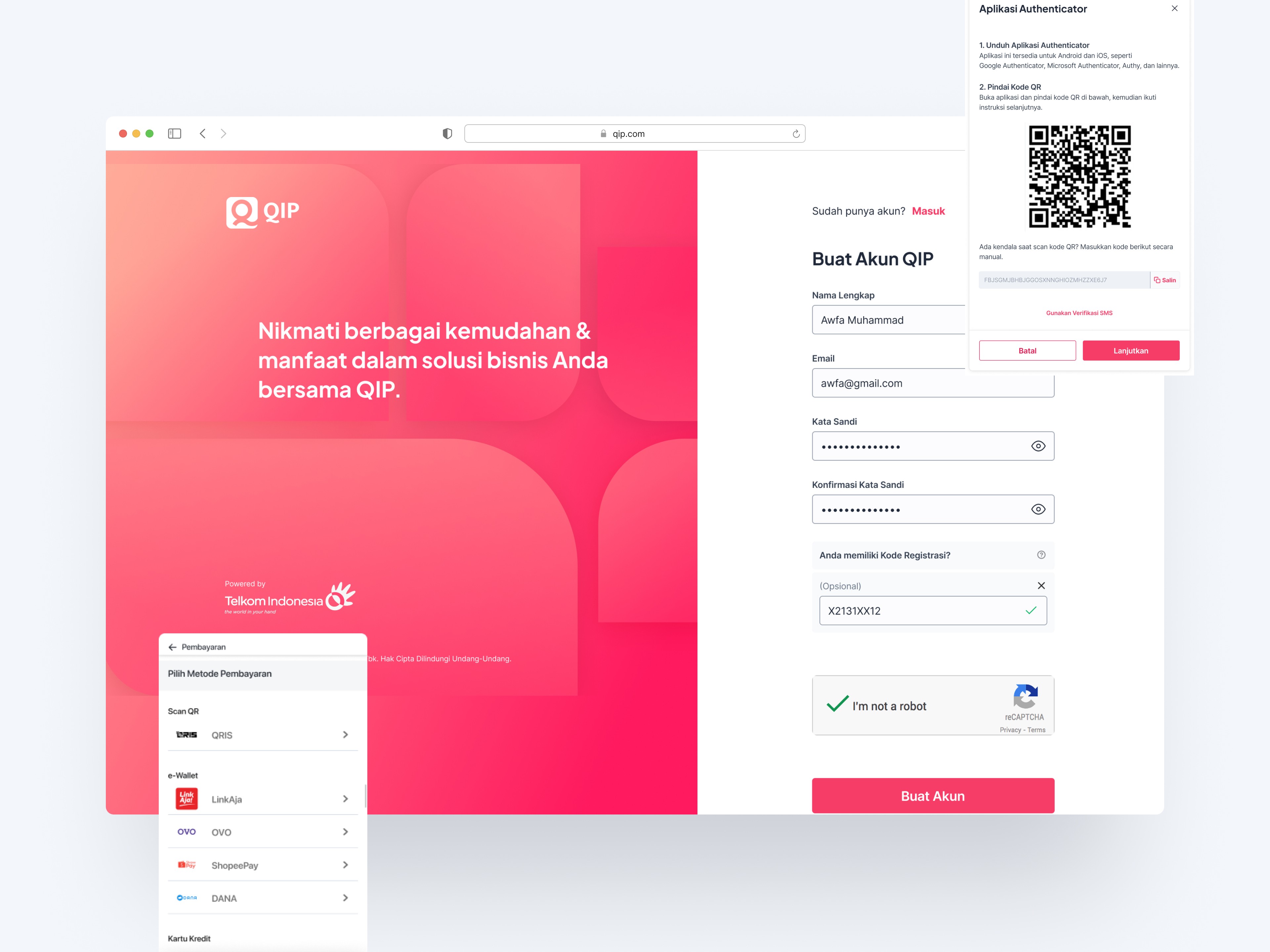

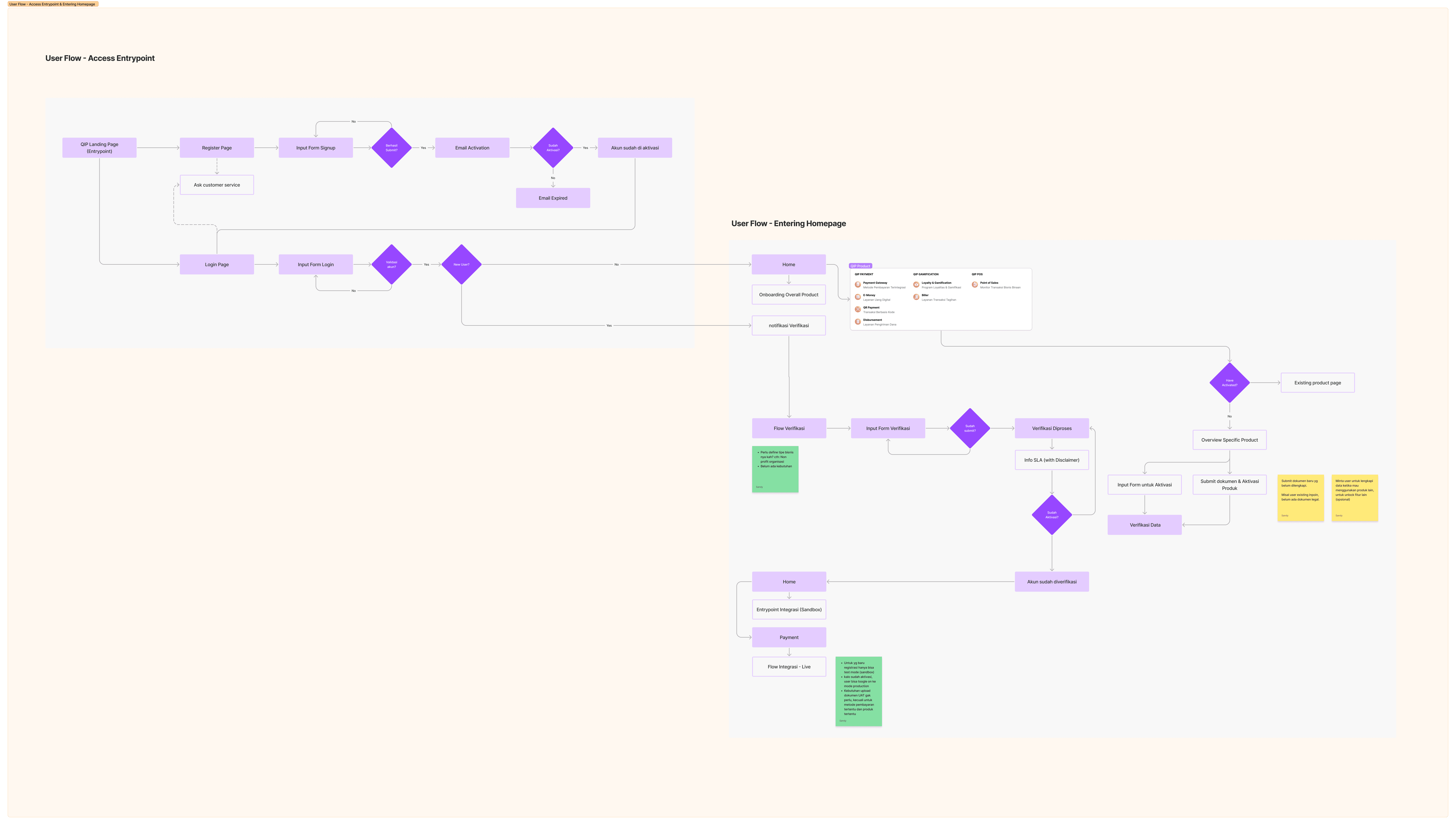

User Flow Register & Verification Business

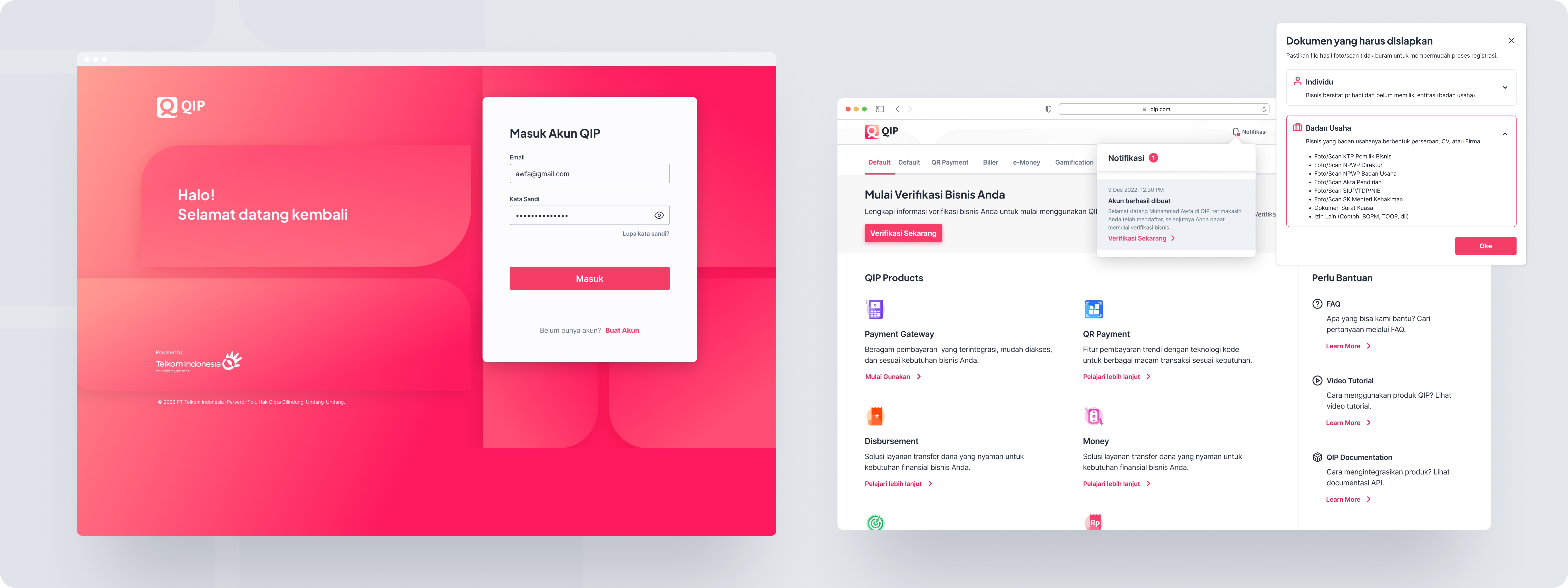

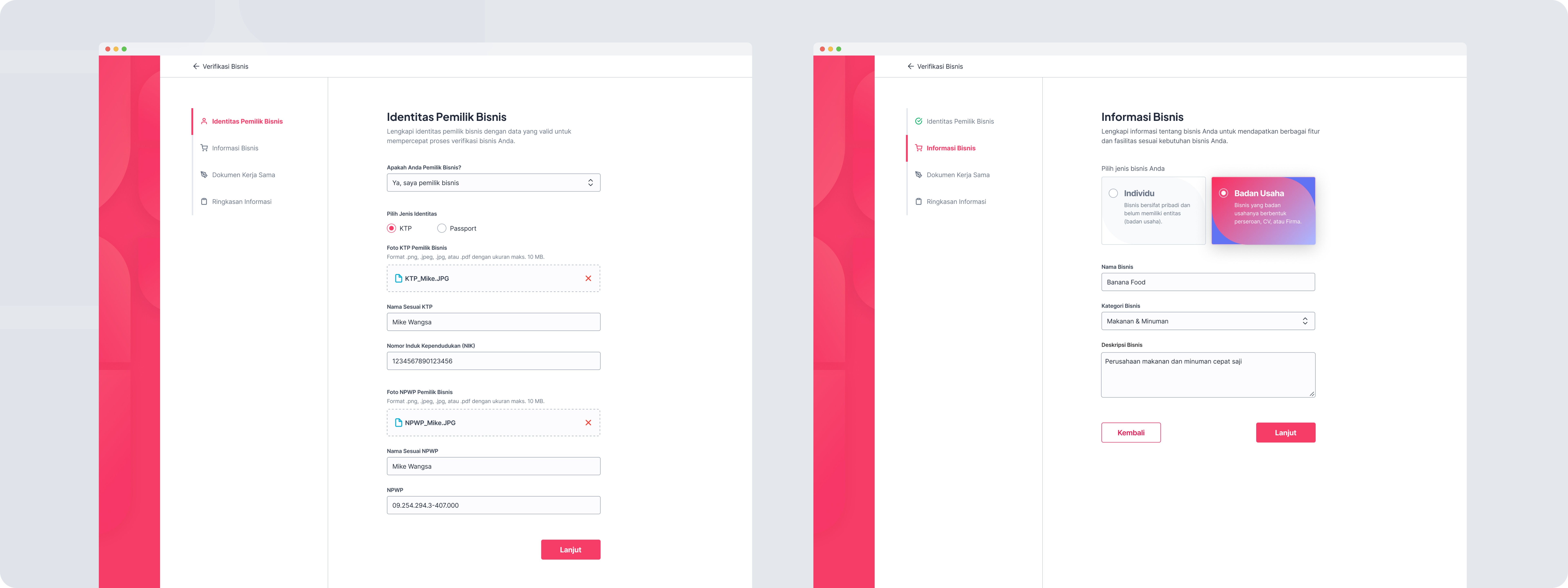

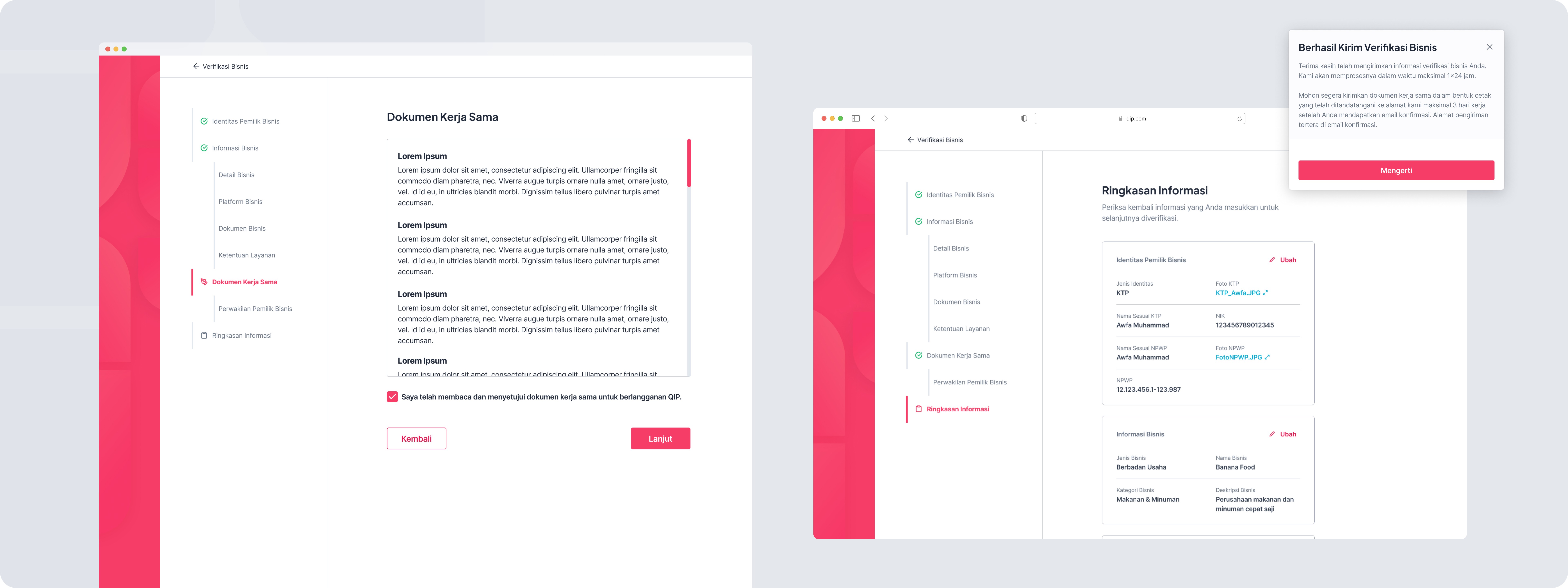

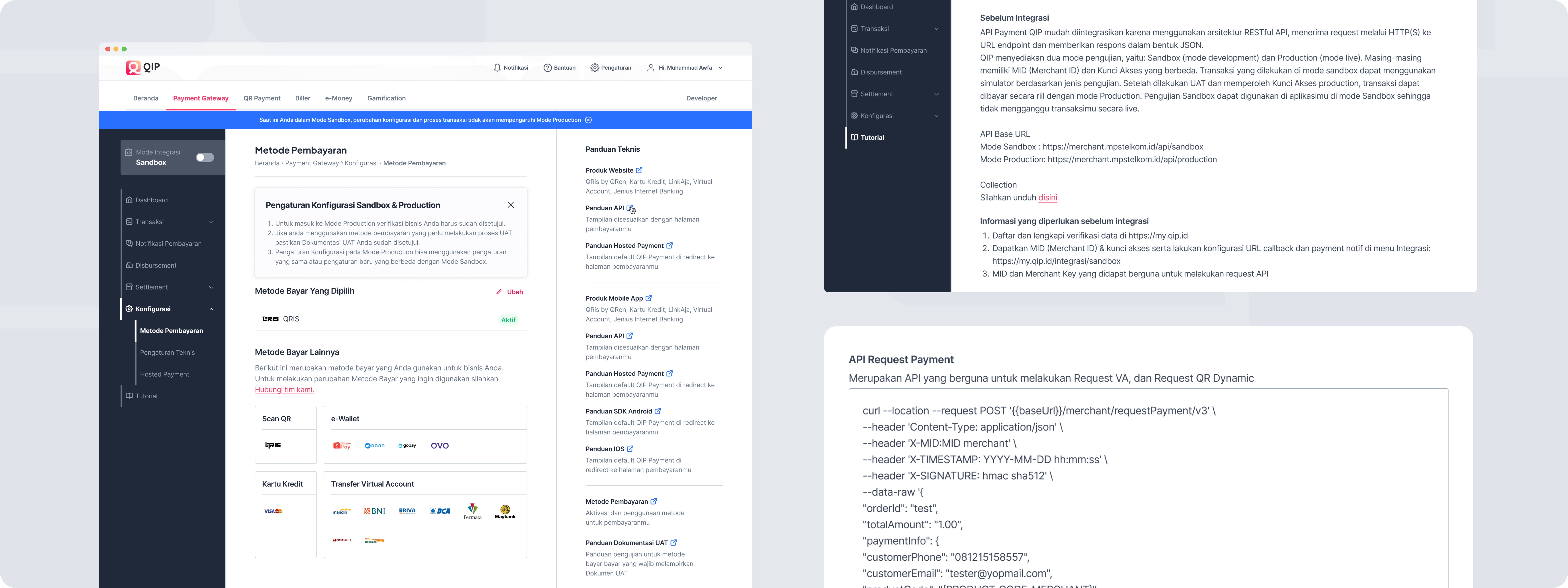

High Fidelity Design

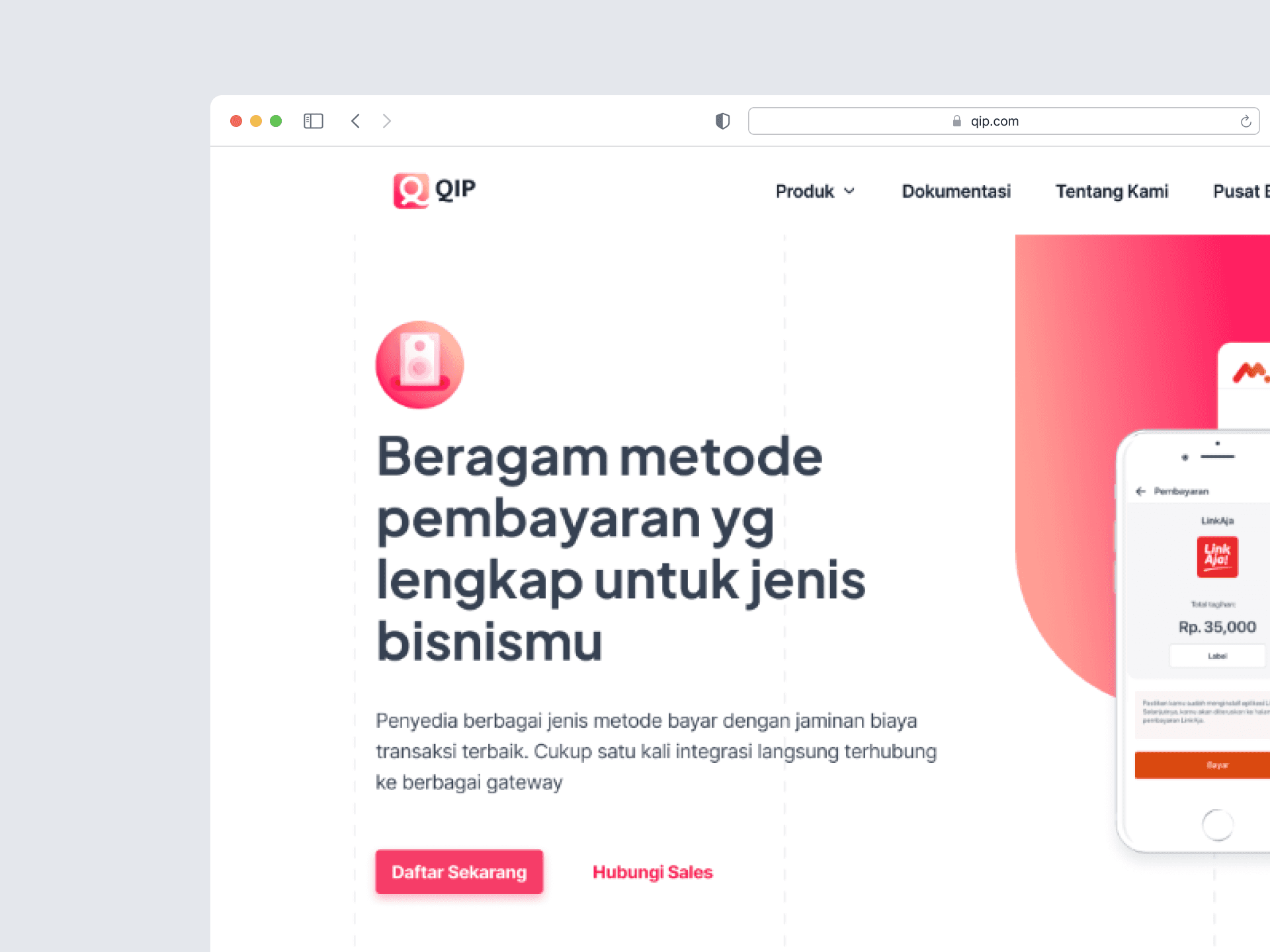

1. The user starts on the QIP Payment landing page.

If the user does not yet have an account, click “Daftar Sekarang.”

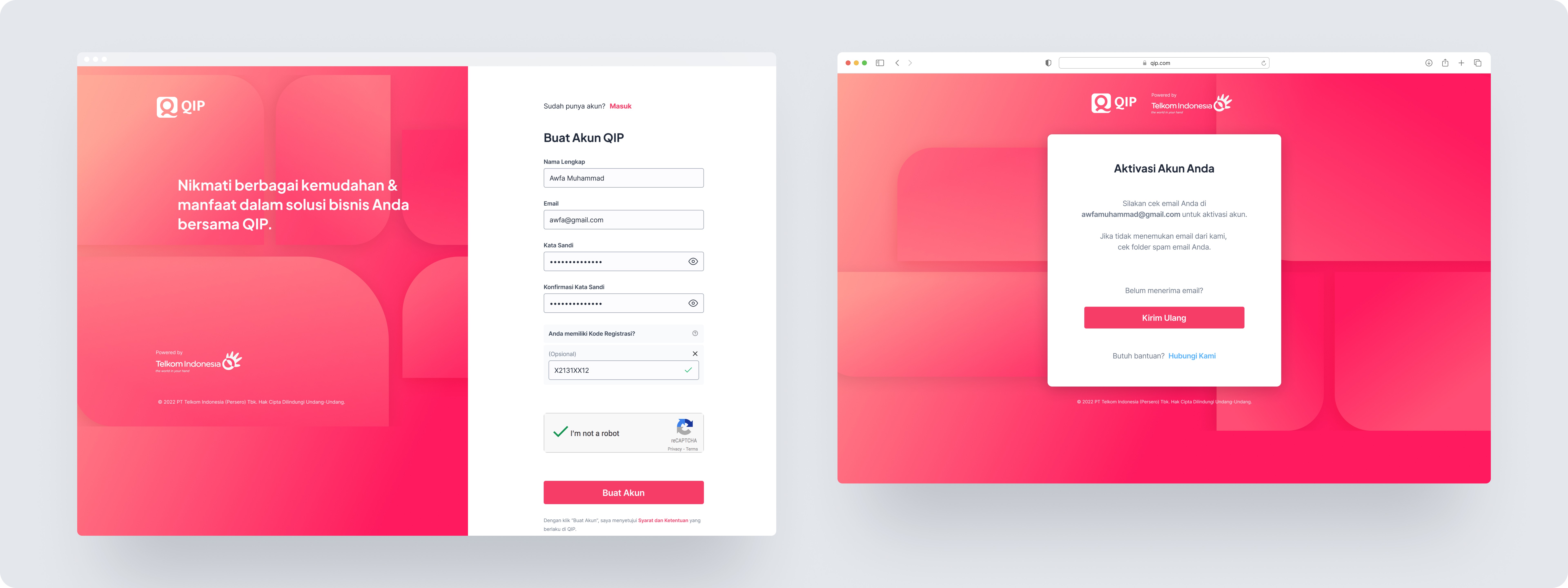

The user is directed to the Registration page, where they create a merchant account and complete the initial account activation.

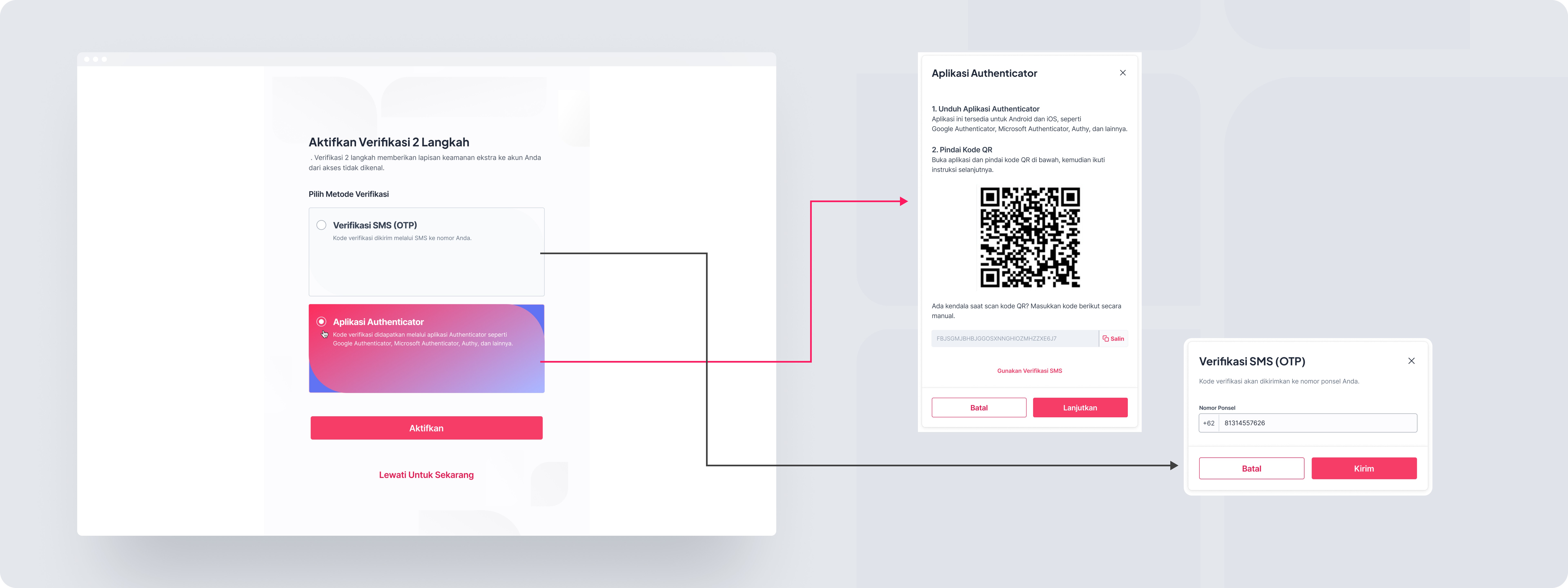

After registration, the user is required to complete Two-Factor Authentication (2FA) using either an Authenticator app or SMS (OTP).

Once the account is successfully registered and verified, the user can log in to view the available services offered by QIP Payment.

To use and integrate QIP services, the merchant must complete Business Verification in accordance with regulatory and platform requirements.

After business verification is completed, the merchant is directed to the Sandbox environment to perform User Acceptance Testing (UAT) before the services are activated for Go Live / Production use.

Reflection & Lessons Learned

Collaboration Drives Results

The strongest outcomes came from aligning marketing, operations, and design early, instead of approaching problems in isolation.

Clarity Builds Momentum

Shared visuals, journey maps, and simple success metrics made it easier for teams to align quickly and move forward with confidence.Action Matters More Than Artifacts

We focused on creating outputs that teams could immediately use and act on, prioritizing clarity and adoption over complex documentation.